In the evolving world of decentralized finance (DeFi), various innovative mechanisms are continuously being developed to enhance trading experiences and improve liquidity on blockchain networks. Among these innovations, the Hybrid Automated Market Maker (AMM) system and the Raydium Order Book stand out as game-changing solutions for decentralized exchanges (DEXs). This article will delve into what these systems are, how they work, and their role in reshaping DeFi trading.

What is an AMM (Automated Market Maker)?

An Automated Market Maker (AMM) is a protocol used in decentralized exchanges to facilitate the trading of assets without the need for a traditional order book or centralized intermediary. Instead of matching buy and sell orders, AMMs rely on liquidity pools – collections of funds provided by liquidity providers (LPs) – to determine asset prices and execute trades.

AMMs work based on mathematical algorithms, the most common being the constant product formula. This formula ensures that the price of an asset adjusts dynamically according to the supply and demand within the liquidity pool.

The Emergence of the Hybrid AMM

The traditional AMM model has served its purpose in decentralized trading, but it comes with limitations, particularly when it comes to handling large trades or less liquid assets. As the DeFi ecosystem grew, the need for a system that could combine the benefits of AMMs and traditional order book models became apparent.

This led to the development of the Hybrid AMM system, which blends the strengths of AMMs and order books. The goal of the Hybrid AMM is to enable deeper liquidity, more efficient price discovery, and better execution of large orders. The key feature of a Hybrid AMM is its ability to leverage both liquidity pools and an order book, allowing users to trade assets more efficiently, even for assets with lower liquidity.

In a Hybrid AMM system, users can either trade directly against a liquidity pool (like in traditional AMMs) or place an order on an order book that is matched with other orders. This system allows for more flexibility in trading strategies and offers a better experience for traders seeking the advantages of both mechanisms.

Raydium and its Hybrid AMM System

Raydium is a prominent decentralized exchange (DEX) built on the Solana blockchain, known for its Hybrid AMM system. The platform combines the benefits of an AMM with an order book, which enables fast and efficient trading with low fees and high liquidity.

Raydium’s approach is unique in that it utilizes Solana’s high-speed blockchain, which significantly reduces transaction costs and speeds up execution times, setting it apart from many other AMM-based DEXs built on slower networks like Ethereum.

The core feature of Raydium’s hybrid system is its integration with the Serum Order Book, which allows the platform to support limit orders and provide liquidity from both the AMM pools and the order book. This hybrid mechanism enhances the liquidity available for traders, offering more opportunities for price discovery and more efficient execution of large orders.

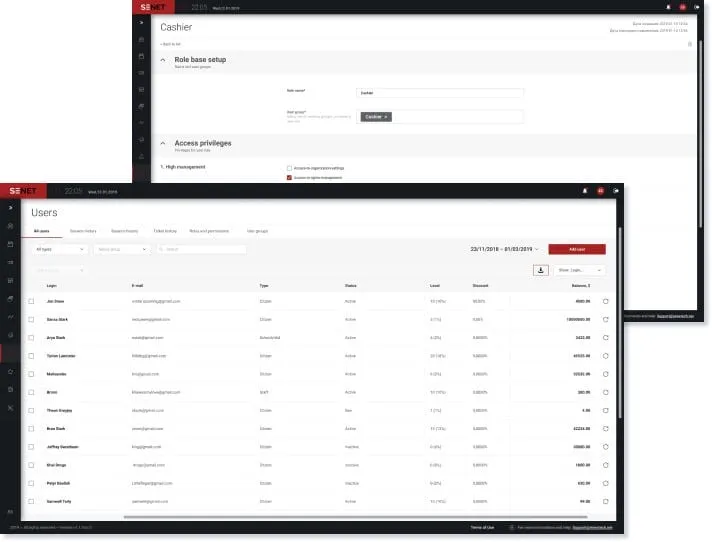

How Raydium’s Order Book Works

Raydium’s Order Book is a central part of its trading system. By integrating Serum's order book with its liquidity pools, Raydium allows traders to place limit orders. When a trader places a limit order, it gets posted to the Serum order book, where it waits to be matched by other traders’ orders. This provides greater flexibility for traders who want to execute orders at specific prices rather than accepting the market price from the AMM pools.

On the other hand, users can also choose to trade directly with the liquidity pools if they prefer to execute trades instantly at the available market price. This combination of the order book and liquidity pools makes Raydium a unique platform that offers the best of both worlds.

Benefits of the Hybrid AMM and Raydium Order Book

Conclusion

The Hybrid AMM system and Raydium Order Book offer a revolutionary approach to decentralized trading. By combining the benefits of traditional AMMs and order books, Raydium ensures that traders can enjoy the best of both worlds—offering deeper liquidity, better price discovery, and the flexibility to execute trades according to their needs. As the DeFi ecosystem continues to grow, Raydium’s innovative hybrid model positions it as a leader in the space, providing solutions that are fast, efficient, and cost-effective.

Reviews